If you run a small business in South Africa and it is registered for tax, then you must have tried to raise a query through the South African Revenue Services (SARS) at some point. To save you the pain and the frustration, let us share with you our 5 simple steps we follow to contact SARS. We consistently use this process every time and, although it takes time, it simply works.

Challenges with the SARS contact centre

There are a number of issues that make contacting SARS a challenge:

- During tax filing season for individuals – you will find the call centre gets particularly busy. Around that time you can hold for more than 1 hour and still be cut-off just as you get closer to the front of the call centre queue.

- You may be enthusiastic and leave a number for SARS to contact you, but during peak time, they likely will not call you back.

- If by any luck you manage to speak to a consultant, you will still be asked to send a letter anyway, depending on your query.

Save your precious time and your valuable airtime – do not make a call first. Rather, do this:

Step 1: Send initial email to SARS

Send email to SARS and in this initial communication, summarise your issue. Address the email to contactus@sars.gov.za. Make sure you use the right description of your query – for example: “Reallocation of funds from this account to this account”. Do not attach anything to the email, just write your summary in the body of the email. Be precise and be specific in terms of the outcome you are looking for. Remember that you will later be requested to submit supporting documentation.

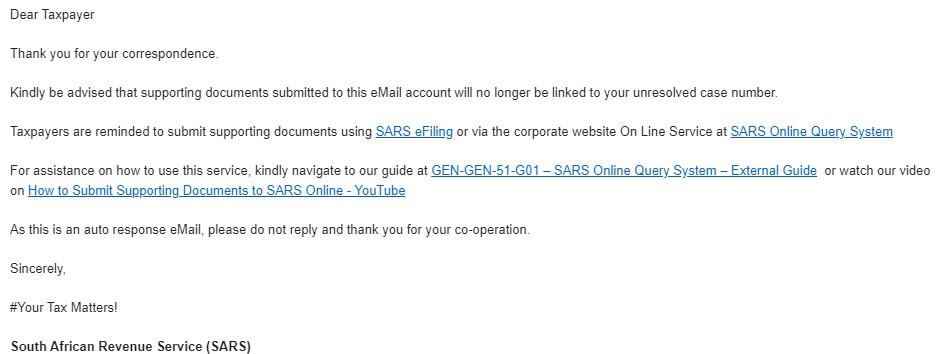

Step 2: Wait for SARS contact centre response

After sending the email to contactus@sars.gov.za, wait.

You will get two automatic responses from SARS:

- One will tell you that if you submitted supporting documentation with your last email, it will NOT be captured. This is because you would have submitted an email without a case number. But recall that you need this initial contact to receive the case number.

- The second automatic response will be to allocate a case number to the initial email that you sent. SARS will ask you in that email to access their site to upload supporting documentation.

Step 3: Write a detailed letter and prepare the pack

Draft a letter to SARS where you go into great detail about your query. Do not use long sentences, just use bullet points and right in the opening line, explain exactly what you are looking to achieve. Be concise and quickly go straight to the point. If you do not do that, you will get a response that answers a question you did not ask.

More importantly, if you have reference numbers, include them, right upfront.

In the detailed letter that you draft, make sure you include the following details:

- Tax Type and tax reference number (e.g. VAT 427123123)

- Your South African ID Number or Passport Number

- Company Registration Number

- Your full names and surname

- Your email address and contact number

Sign the letter and scan it.

If necessary, Scan the signed letter with all supporting documentation, for example, statement of accounts, demand letters, reminders, etc. label the supporting documentation well and make sure the letter describes all additional attached documentation attached.

This pack will be your “Supporting Documentation”.

Step 4: Upload documentation to SARS contact centre

This is how you upload supporting documentation.

- Go to the SARS website

- Click “Contact Us”

- Scroll down to “Supporting Document Upload”.

- Make sure you enter the case number that was sent to you via email in step 2.

- Complete all the other fields, and then upload the documentation that you have already scanned in step 3.

- The allowed document types are PDF, JPG, PNG, BMP but scanning all the document into 1 PDF makes more sense.

- Pay attention to the name of your supporting document, it should not have special characters like question marks and hashes and make sure it is under 5MB in size.

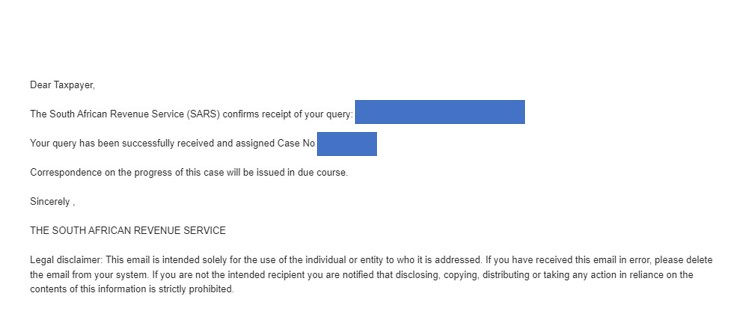

- Ensure that you have received confirmation from SARS that your supporting documentation was received.

Step 5: Wait for 21 Day Service Level Agreement

- The SARS SLA is 21 working days unfortunately, and it is pointless to contact SARS before the 21 day SLA is passed.

- On the day the 21 working days expire, if your query is not resolved, make sure you call SARS to “Escalate”.

- Unfortunately, for the escalation you need to speak to someone at the call centre and you will need your case number. Once escalated, you need to wait a maximum of 21 days for your query to be resolved. d.

- After 21 days, if your query is still not resolved, you need to lodge a Complaint. That is a different process altogether- look out for a blog on this process.

- Then eventually, if none of these mechanisms have worked, you may need to contact the Office of the Tax Ombud (OTO).

Further reading

For other guides and articles on governance, please refer to that section of our site.