Submit annual returns, or risk a bank account freeze

I speak from personal experience. A property holding company that belongs to a few of my family members had its bank account frozen because of the status of the company at the Companies and Intellectual Property Commission (CIPC). For that reason, we could not pay rates and taxes until this issue was resolved, but fortunately the impact was minimal.

As a small business, the requirement to maintain your registration details at the CIPC is key. You cannot access many services when you do not have a fully compliant registered entity. Services range from banking and funding, and it includes support opportunities from, for example, the Small Business Development Agency, Small Business Finance Agency, incubators, accelerators, export/import government agencies and so on.

Do not confuse the annual returns at the South African Revenue Service (SARS) with the annual returns at the CIPC.

You need to understand these ten key facts about filing the annual returns at the CIPC:

- If your company is either a close corporation (CC) or a Proprietary Limited ((Pty) Ltd), then you are required to submit annual returns at the CIPC in terms of: 9a) Section 15A of the Close Corporations Act (regulation 16); or (b)Section 33 of the Companies Act (regulation 30). Failure to do so puts you at a risk of running a business that does not comply with regulations and this means that potential funders that look for your company registration details at the CIPC will pick up red flags when they find your company in a “Deregistration” status.

- A CIPC registration is like a license to start a business, and as with many formal registrations, an annual return is required to maintain the registration. This is over and above any industry-specific regulations and compliance that you may need to comply with, for example the Construction Industry Development Board (CIDB) for construction companies.

- The filing of the annual returns at the CIPC must not be confused with the filling of annual returns at the SARS. The two processes are different, and their outcomes are not related. At the SARS, the objective is to determine how much taxable income you have made for the year and how much you need to pay. At the CIPC, annual revenue is used to measure how much you need to pay in fees to maintain your company registration.

- Note that the systems at CIPC and SARS are linked. The functionality to allow a new company incorporator to register for tax has been in place for a number of years now. This functionality requires you to be factual when you report your earnings. You cannot declare, for example, a lower revenue at the SARS to lower your tax income and then report a different revenue at the CIPC. Where the numbers do not agree, you must be able to explain that difference.

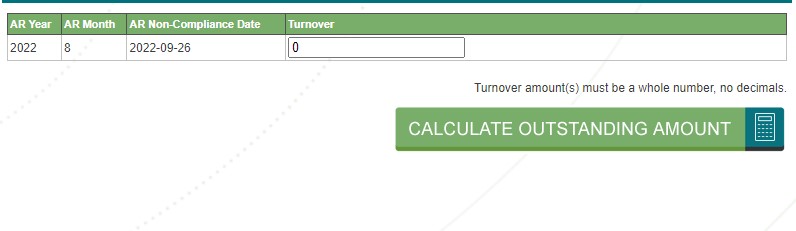

- The CIPC annual returns are due 30 days after the company anniversary date. If your business was registered in August 2022, your returns are due in Sept 2023. If you miss this date by two months, the CIPC can remove the juristic personality from its records and the company or CC ceases to exist from then on. The mistake to be avoided is the assumption that the annual return at the CIPC is automatically due after your financial year-end.

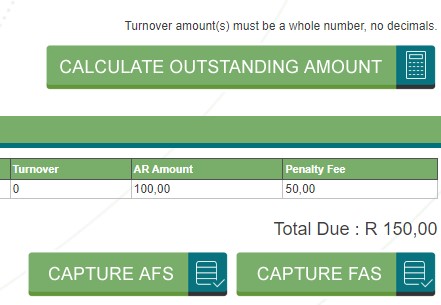

- Annual Return fees are payable, from R100 for companies with turnover of R1 million and below, to over R4000 for companies with turnover of R25 million and above.

- You need to do annual returns even if your company is not actively trading. If you do this, you will be required to pay late fees for all the years you did not comply with the returns process. Many people register companies but for some or other reason, the companies do not start operating until a few years later. If you kept a dormant company for 3 years, at the time you need to start trading using the same company, you will need to pay all the missed annual returns. Where you have a registered entity that is not operating, you need to file what is normally called “Nil Returns,” in other words, declare the zero income for that year and maintain your registration. The same applied to the SARS. If you miss returns, you may be liable for late penalties.

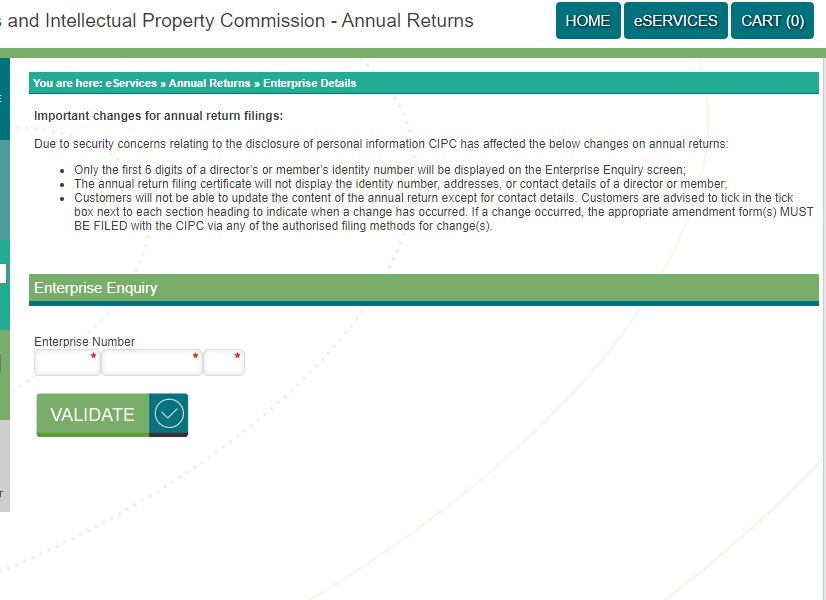

- Small businesses must file what is termed FAS (Financial Accountability Statement) on e-Services, and NOT Annual Financial Statements (AFS). The AFS are for very large businesses and the process itself is much more technical. The Financial Accountability Statement is merely a questionnaire around your turnover, directors, company address, etc., and so if you run a small business and you find yourself on a CIPC e-Services site that requires you to do an XBRL upload, you are at the wrong site.

- Once the status of a company or close corporation reaches a “Final Deregistration” status, it is not all lost, the company or close corporation or any third party may still apply for a re-instatement. There are many companies that stay in this status for a long time, but also note that the CIPC has started to look very urgently at decreasing the number of years a company remains in “Final Deregistration”.

- If you require a re-instatement of a company that is in a “Final Deregistration” status, CIPC will only process the re-instatement application under the following conditions: (a) The company or close corporation has proof that it is still in business, for some or other reason, annual returns were missed; (b) There are still immovable properties registered in the name of the company or close corporation; or (c) A creditor provides proof that they will be unfairly prejudiced if the company or close corporation is not reinstated.

In conclusion, banks are no longer lenient when it comes to annual returns and we believe this has something to do with the South African government grey-listing by the Financial Action Task Force. Make sure you comply with this registration requirement to continue operating as a business, it is the requirements of the law and cost of non-compliance can be huge.

Filing annual returns

Select Enterprise

Calculate Outstanding Amount

Select FAS or AFS