Becoming a mobility entrepreneur is now made easier for people who previously had difficulties securing loans from commercial banks. A company called Moove makes it possible for people to get into the last-mile delivery or e-hailing business through their innovative Drive-to-Own model.

The Business

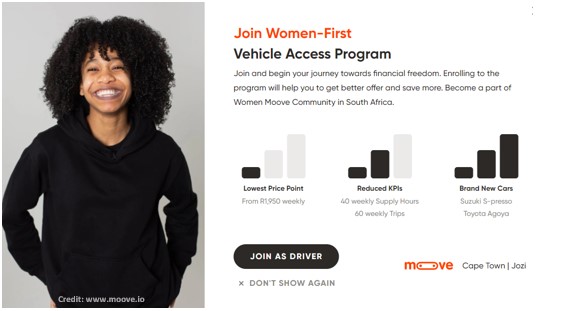

Moove, is a mobility Fintech that provides the funding that empowers individuals to become vehicle owners to start their own mobility businesses. Moove makes it easier for the drivers through, amongst other mechanisms, their alliances with platforms such as Uber. The Fintech offers approved individuals with drive-to-own contracts, a vehicle, and access to a trading platform (e.g. UberGO). This enables the entrepreneur to start earning money from deliveries and to start paying back the car loan on a weekly basis. Typically, the R2000 a week repayment in South Africa includes includes insurance and maintenance on the compact, low maintenance and cost-effective models.

What is different about Moove?

In South Africa one of the vehicles that is made available through a drive-to-own model is a one litre Toyota. However, in other countries, drivers can choose other compact vehicles including motorbikes and lorries. What is different about this Fintech is the means and the mechanism to include people that would normally have no access to this type of a financial service. They have developed an alternative to credit scoring, and they continuously evaluate driver risk. Furthermore, especially in South Africa, they are looking to have 50% of women as drivers on their platform.

Founders

Moove was founded in 2020 by British-born Nigerians Ladi Delano and Jide Odunsi from and operates in 13 cities across South Africa, Nigeria, Kenya, Uganda, Ghana, India, the UK, and the list is growing. It is headquartered in the Netherlands and has a lengthy list of global investors that have funded the business through its phenomenal growth.

Recent development

The Fintech is in the news recently because they have pledged a $240 million investment in South Africa to roll out a further 1400 vehicles in 2024. Mobility entrepreneurship continues to present a good opportunity for people who require flexibility and a structure within a proven business model.

Other Stories

We shine our spot light on successful entrepreneurs – read more stories here.