It is not complicated for small businesses to comply with Value-added Tax (VAT) regulations at the South African Revenue Service (SARS) and to conclude a SARS VAT Audit. You file your VAT 201 return on time, make an immediate payment when VAT is due and receive a refund if no audit is required. However, what is supposed to be a straightforward process can be turned into a protracted nightmare.

When we filed our VAT return (VAT 201) with SARS in June 2023, we expected a refund by August 2023, after factoring in the VAT audit process that is sometimes required. We were requested to submit supporting documentation for audit, and over months, we were never requested to submit further information, no technical issues were raised, no administrative issues were raised and there was no debt to offset against. After many hours on the phone and a number of expired 30-day SLAs, and just as we were escalating to the Tax Ombud 6 months later, the audit was concluded, and the refund was paid.

This experience shows how even perfectly compliant businesses can face unexpected delays that may put them at a huge risk of closing down. Recently, SARS was ordered to pay costs associated with the legal process that was initiated against it as a result of the VAT audit process that exceeded reasonable timelines to complete. The order also provided the company an opportunity to bring into the matter other costs incurred because of the lengthy audit process.

The Case That Changed the Game

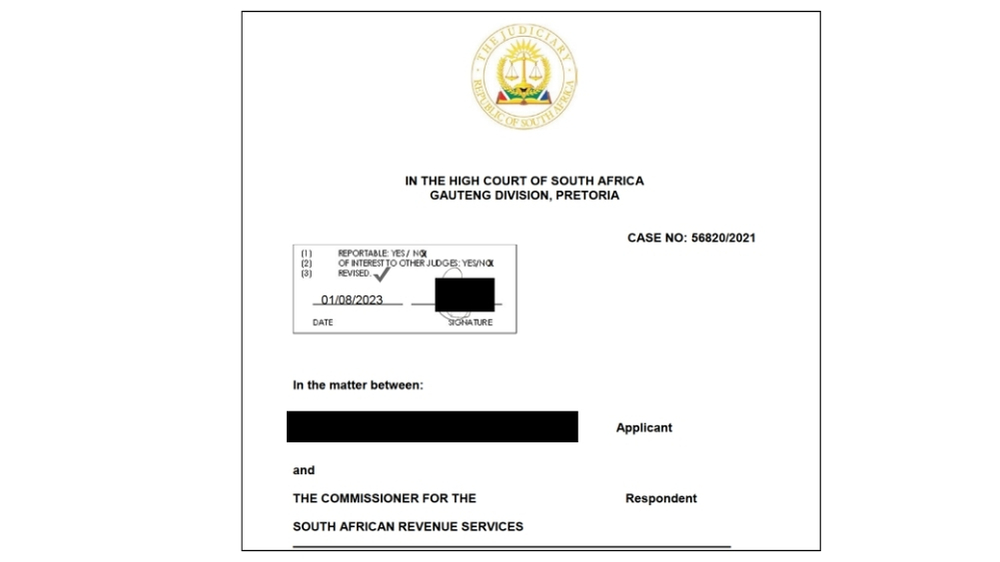

In a groundbreaking case that has implications for small businesses across South Africa, the courts established clear guidelines on how the South African Revenue Service should conduct VAT audits. The case involved a business that faced severe financial consequences, similar to what we went through, due to SARS’s prolonged VAT audit process.

SARS initiated an audit in July 2020 and the company demonstrated full cooperation by promptly submitting all requested information from September 2020 to June 2021. This included participating in a field audit and cooperating with interviews. After June 2021, SARS made no further information requests, went cold and failed to provide any progress updates. It turns out that during the time the SARS was also investigating supply chain issues in the Gold sector that the company operates in but did not disclose this; or the reasons for the delays.

The financial impact on the company was severe, they lost a revolving VAT loan facility, the company’s operations were severely curtailed, forcing them to sell core assets, retrench staff, suspend commission payments to agents and saw staff resignations due to this situation.

Despite the company’s attempts to seek resolution through several requests between July and October 2021 for SARS to finalise the audit, they received no feedback. The company ultimately filed a legal application in November 2021. Only after this legal action did SARS contact them about consenting to a tax enquiry, and it was during the court proceedings that SARS finally revealed their broader concerns about the gold supply chain. Throughout this period, SARS failed to explain the delays or provide legally required progress updates until forced to do so through legal channels.

The judgement of the case

In summary, the court delivered this ruling:

- While SARS has the right to conduct audits, these must be completed within reasonable timeframes

- The tax authority must maintain communication throughout the audit process

- Failure to provide progress updates violates Section 42(2) of the Tax Administration Act

- Businesses can seek legal recourse when facing unreasonable delays

Implications of the VAT Audit to small business owners

For small business owners, this case establishes several crucial precedents:

- SARS must provide regular progress updates during audits

- There are legal remedies available when audits drag on unreasonably

- The tax authority must consider the commercial impact of delayed audits

- Businesses have the right to procedural fairness throughout the audit process.

Minimising risks associated with VAT Audits

Based on this case, here are practical steps small businesses can take:

- Document Everything: Keep detailed records of all communications with SARS and maintain a timeline of information submitted

- Request Regular Updates: Formally request progress updates if SARS doesn’t provide them

- Track Financial Impact: Document any financial prejudice caused by audit delays

- Seek Professional Advice: Consider consulting a tax professional if audit delays begin affecting your business operations

- Know Your Rights: Familiarise yourself with the Tax Administration Act’s requirements regarding audit procedures

Managing Business Operations During Audits

Small businesses that are going through a growth phase and expect relatively large VAT refunds must consider implementing the following strategies to minimise disruptions:

- Maintain separate records for all VAT-related transactions

- Keep adequate cash reserves to manage potential refund delays

- Develop contingency plans for extended audit periods

- Consider alternative financing options in case of delayed refunds

- Maintain open communication with suppliers and stakeholders about potential audit impacts

The Broader Impact on South African Business

This ruling represents a shift in the balance between SARS’s investigative powers and the rights of businesses to fair administrative action. It acknowledges that while tax compliance is crucial, the process shouldn’t cripple legitimate business operations. This is particularly important for small businesses, which often operate with tighter cash flows and smaller margins.

This case firmly establishes clear obligations for SARS while providing businesses with concrete legal protections against unreasonable delays. The goal is not to obstruct legitimate audit processes but to ensure they are conducted fairly and efficiently, with minimal disruption business operations.

Further reading

For other guides and articles on governance, please refer to that section of our site.